Enable a seamless checkout experience by integrating its payment presentation and interoperability features to enhance the checkout experience with up-to-date payment method listings.

Integration overview

This guide explains how to provide dynamic Klarna assets to Partners using Klarna’s Presentation API, enabling them to create their own payment selector in line with Klarna’s best practices.

Below is a step-by-step overview for supporting dynamic payment method listing:

- Accept

interoperability_tokenandinteroperability_datain requests. - Call Klarna’s Payment Presentation API

- Include Klarna-specific display instructions and assets (labels, icons, etc.) in the API response sent to Partners.

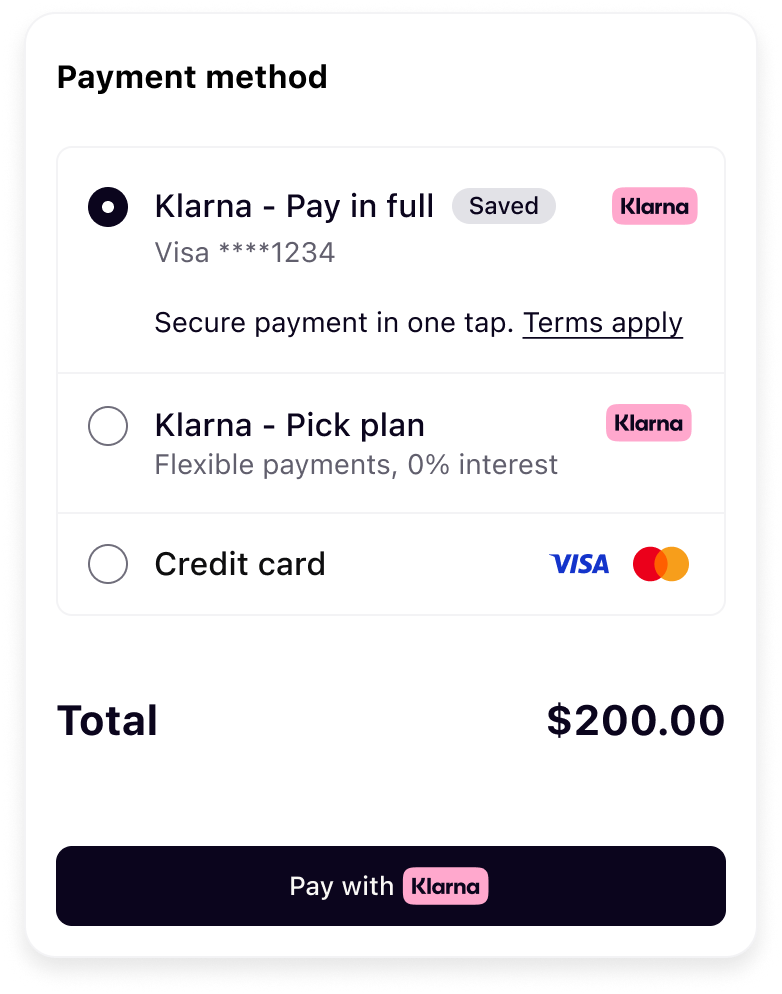

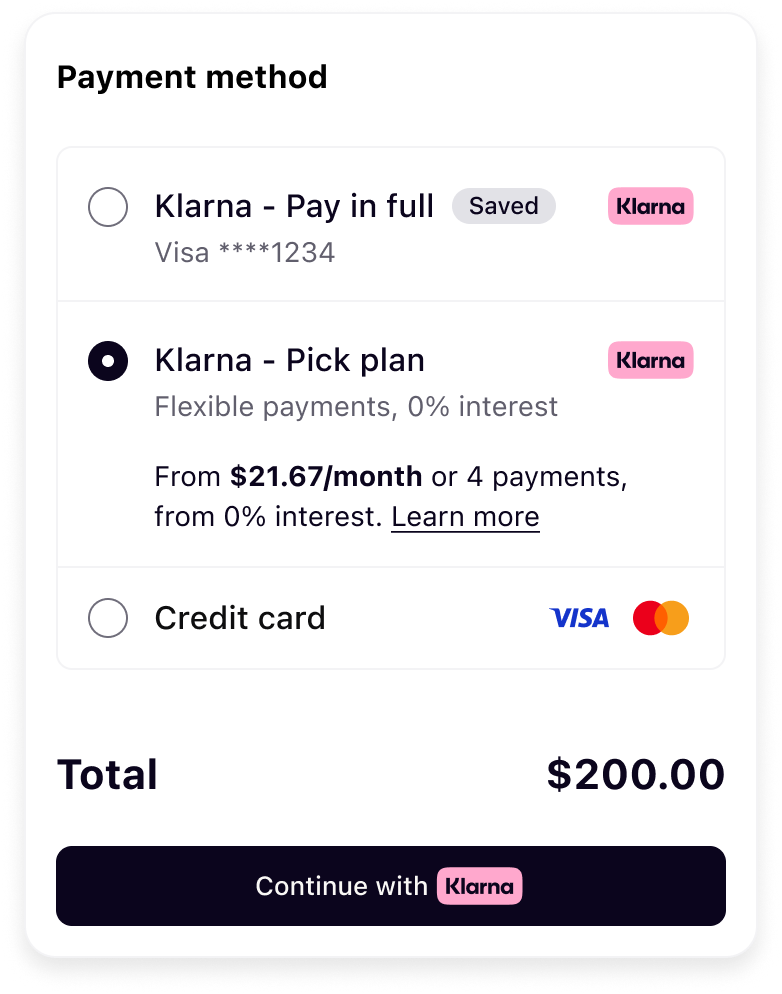

Example of the payment selector built by a Partner when the Acquiring Partner enables this support:

|  |

| Tokenization purchase selection | Pick Plan selection |

This step only applies to Acquiring Partners that have APIs that allow Partners to retrieve available payment methods. It is identical to the server-side only integration for one-time payments.

Integration details

Accept Klarna Network data points

klarna_network_session_token- Encodes Klarna session context, such as payment option preselection, prequalification results, or payment approval

- May be present on the initial authorization request

- Required when finalizing authorization after a step-up flow

klarna_network_data- Encodes additional Klarna Network context supplied by the Partner, including supplementary purchase data

- Must not be parsed, enriched, or transformed

Below is an example of how Acquiring Partners can accept the Klarna Network parameters in their Partner-facing APIs.

Requirements

- Accept the Klarna Network parameters in the Partner-facing APIs.

- Use the field names

klarna_network_session_token/klarna_network_data, ensuring that it’s easy for any Partner to identify and use. - Validation should be implemented, but it must not be more restrictive than what is specified in Klarna’s Payment Authorize API

- All printable UTF-8 characters must be supported

- Forward the Klarna Network parameters unmodified to Klarna.

Call the Payment Presentation API

/v2/accounts/{partner_account_id}/payment/presentation| Parameter | Required | Description |

|---|---|---|

partner_account_id | Yes | Unique account identifier assigned by Klarna to the onboarded merchant |

Return Klarna presentation data to the Partner

Your API response (e.g., for Get Payment Methods) should include the Klarna assets returned in the response from the Payment Presentation API, so your Partner can render the payment method correctly.

You have two options:

- Map individual fields: Extract and structure the response from Klarna’s Payment Presentation API and map relevant keys (e.g.,

descriptor,payment_button) into your API response format. - Serialize the entire response: Alternatively, you may populate a single field—

klarna_payment_presentation_data—with a serialized version (e.g., JSON string) of the full response obtained from Klarna’s Payment Presentation API. This avoids the need to map each field individually.

{

"payment_methods": [{

"name": "VISA",

"type": "scheme"

}, {

"name": "Pay with Klarna",

"type": "klarna",

"klarna_payment_presentation_data": "{\"instruction\":\"SHOW_KLARNA\",...}"

}]

}

You may structure the response to fit your API format, but ensure that the Klarna presentation data is clearly identifiable. Use a field name like:

klarna_payment_presentation_data- or

payment_presentation_data(when used specifically for Klarna)

This makes it easy for Partner integrations to parse and use Klarna presentation data dynamically.