Manage payment disputes effectively with Klarna’s Dispute API by integrating dispute handling, tracking lifecycle stages, and providing evidence for swift resolution.

A "dispute" occurs when a customer questions a payment due to issues like not receiving goods, unauthorized transactions, or dissatisfaction with a product. Efficiently managing disputes through Klarna’s Dispute API allows Partners to respond in a structured manner, minimize financial impact, and resolve issues promptly.

Acquiring Partners who present disputes within a dashboard are required to integrate Klarna dispute handling, such that the friction of dispute handling for Klarna does not differ from other payment methods. By following these guidelines, Partners can protect their finances and keep strong relationships with customers. Efficiently resolving disputes reduces chargebacks and builds customer loyalty.

Alternate dispute solution

For Acquiring Partners without a dispute handling flow or Partner-facing dashboard, direct provisioning of Klarna’s Partner Portal may be given to Partners, allowing direct management of disputes.

Integration of Disputes webhooks by the Acquiring Partner is still recommended in these cases, to ensure the Acquiring Partner has visibility on risk factors and outstanding dispute cases.

Dispute lifecycle and states

A dispute typically progresses through several states from initiation to resolution. Understanding these states is crucial for effectively managing disputes:

Pre-arbitration

Overview: A customer initiates a dispute.

Webhook: payment.dispute.state-change.pre-arbitration

Recommended action: Partners should review the related transaction and consider reaching out to the customer to resolve the dispute directly.

Alternatively, Partner may accept the loss with the acceptLoss

State duration: The duration a dispute remains in Pre-arbitration depends on the type of dispute.

| Dispute reason | State duration |

|---|---|

| Purchase Unauthorized | Will transition immediately to Arbitration Pending. |

| Return not possible Return not refunded Products or services not received Products defective or not as described Incorrect amount | Will remain in the initial state for 21 days before transitioning to Arbitration Pending. |

Klarna discretion: Klarna dispute agents have the authority to advance a dispute to the next state prior to the completion of the 21-day period, based on their discretion. These scenarios include, but are not limited to:

- Debt collection (this applies to integrators which implement Klarna Debit Risk)

- High volume of customer complaints

- Claims raised by an external authority

Arbitration Pending

Overview: The deadline for Merchant and customer to resolve the dispute directly has expired, Klarna will now investigate the dispute.

Webhook: payment.dispute.state-change.arbitration-pending

Recommended action: This stage represents that Klarna is deliberating the dispute details and merchant evidence provided. The first time a dispute enters this stage, it typically immediately transitions to Merchant Evidence Pending (since there is not yet any evidence provided by merchant to review).

There is no action expected of Partner while dispute is in this state.

Merchant Evidence Pending

Overview: Klarna requests evidence from the Partner/Merchant.

Webhook: payment.dispute.state-change.merchant-evidence-pending

Recommended action: Partners/Merchants must upload and attach evidence via the Dispute API.

- Upload the merchant evidence

payment_dispute_attachment_id.This first step simply uploads the file to Klarna, but it has not yet associated it to the dispute. - Respond to evidence request

payment_dispute_attachment_idinto theattachmentsfield of this request. This now associates the evidence to the particular dispute.

State duration: Partners/Merchants are given 14 days to attach evidence. The dispute will remain in this state until evidence is submitted, or the window for evidence submission expires.

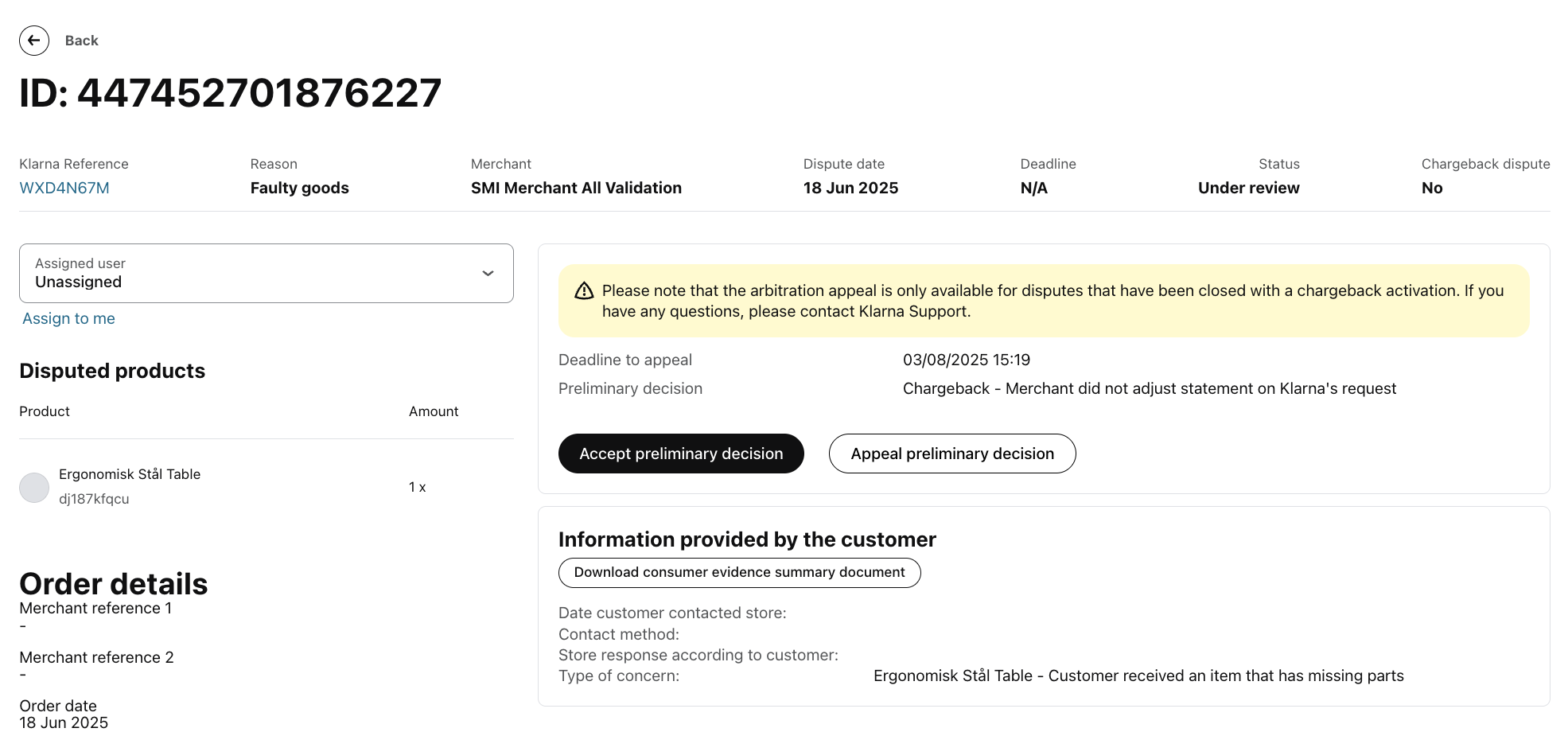

Arbitration Appeal Open

Overview: An initial decision has been made by Klarna in favor of customer. Merchants are able to submit an appeal for a dispute decision by providing a summary of Klarna's decision error and supporting evidence.

Webhook: payment.dispute.state-change.arbitration-appeal-window-open

Recommended action: Partners/Merchants can submit the appeal

State duration: Partners/Merchants have 10 days to submit an appeal. The dispute will remain in this state until an appeal is submitted, or the dispute is closed after 10 days of no appeal submission.

Closed

Overview: Final dispute resolution is reached

Webhook: payment.dispute.state-change.closed

Recommended action: If the dispute closes in favor of the customer, the Partner/Merchant may incur a chargeback. If the disputes closes in favor of Partner/Merchant prevails, no additional action is required.

Common dispute use cases

Disputes can arise in various situations during a payment transaction. Below are some scenarios to illustrate different pathways to resolve disputes. A dispute is considered resolved once:

- Loss accepted: If the evidence clearly supports the customer’s claim, the partner may choose to accept the loss and issue a refund or replacement.

- Closed - lost: Evidence provided by the Partner was insufficient, resulting in Klarna ruling in favor of the customer.

- Closed - won: Evidence provided by the Partner proved that they acted appropriately and all goods were delivered as promised, resulting in Klarna ruling in favor of the Partner.

Accept loss

In certain situations, it may be more practical for a partner to accept a loss rather than contest a dispute. Accepting a loss means acknowledging that the customer’s claim is valid and agreeing to resolve the dispute by issuing a refund or replacement without further investigation. This approach can save time and resources, especially when the evidence strongly supports the customer or when the cost of defending the dispute outweighs the potential loss.

Consider accepting a loss in the following scenarios:

- Strong evidence against the partner: The evidence provided by the customer is compelling, such as clear proof of non-receipt, unauthorized transactions, or defective products.

- High cost of defense: The cost of gathering and submitting additional evidence, such as legal fees or operational costs, exceeds the amount in dispute.

- Customer relationship considerations: Maintaining a positive relationship with the customer may be more valuable than the disputed amount, especially in cases involving loyal customers or high-value transactions.

- Small disputed amounts: When the amount in dispute is relatively small, it may not be worth the effort to contest the dispute.

Accepting a loss can have several implications:

- Financial adjustments: The disputed amount will be refunded to the customer, and any associated fees, such as chargeback fees, will be applied to the partner.

- Impact on payouts: Accepting a loss may result in adjustments to your payouts, depending on the payment method and terms of the dispute.

- Customer trust: Resolving the dispute quickly and amicably by accepting a loss can enhance customer satisfaction and loyalty.

The process for accepting a loss typically involves the following steps:

- Review the dispute: Assess the evidence provided by the customer and determine if accepting the loss is the best course of action.

- Use Klarna’s dispute API or Merchant Portal Disputes App: To accept the loss, make the appropriate API call through Klarna’s Dispute API. This action will close the dispute and trigger the refund process.

- Document the decision: Keep a record of the decision to accept the loss, including any evidence reviewed and the reasoning behind the decision. This documentation can be valuable for future reference or internal audits.

- Encourage partner to communicate with the customer: Proactively notify the customer that their dispute has been resolved in their favor. This communication should be clear, concise, and appreciative, reinforcing a positive customer experience.

Example FashionFusion, an online store, receives a dispute from Karen, a customer claiming that the handbag she received was damaged. Karen provides clear photos showing the damage, and the cost of shipping a replacement is low compared to the potential cost of contesting the dispute. After reviewing the evidence, FashionFusion decides to accept the loss and promptly issues a refund to Karen. This resolution not only saves time and resources for FashionFusion but also leaves Karen satisfied with the quick and fair resolution.

Upload shipping/delivery evidence

Providing shipping or delivery evidence is crucial in resolving disputes where a customer claims non-receipt of goods or delayed delivery. By submitting clear and accurate evidence, you can substantiate that the goods were shipped or delivered as agreed. This evidence plays a vital role in defending against disputes and ensuring that the resolution process is fair and transparent.

Importance of Shipping/Delivery Evidence: In disputes involving non-receipt or delayed delivery of goods, shipping or delivery evidence is often the deciding factor. This evidence helps verify that the transaction was completed according to the terms agreed upon by both the partner and the customer. Without this evidence, the dispute is likely to be resolved in favor of the customer, potentially leading to financial loss and a negative impact on your business’s reputation.

You can submit various types of evidence to support your case, including:

- Shipping receipts: Documentation that confirms the goods were shipped to the customer’s address.

- Tracking numbers: Unique identifiers provided by the shipping carrier that allow tracking of the shipment’s progress.

- Delivery confirmations: Proof from the shipping carrier that the goods were delivered to the specified address. This may include a signature or electronic confirmation.

- Shipping labels: Images or scans of the shipping label that was attached to the package, showing the destination address and other relevant details.

To effectively upload and submit shipping or delivery evidence, follow these steps:

- Gather the necessary documents: Collect all relevant documents related to the shipment, such as tracking numbers, shipping receipts, and delivery confirmations.

- Use Klarna’s dispute API or Merchant Portal Disputes App: Access Klarna’s Dispute API to upload the evidence. The API allows you to attach files and submit them as part of your response to the dispute. Ensure that the documents are clearly labeled and easy to identify.

- Verify the information: Before submitting, double-check the evidence to ensure it is accurate, complete, and directly related to the disputed transaction. Incorrect or incomplete evidence may weaken your case.

- Submit the evidence: Use the API to upload and submit the evidence. Once submitted, Klarna will review the documentation as part of the dispute resolution process.

- Track the dispute status: After submitting the evidence, monitor the status of the dispute through Klarna’s webhooks or API updates. This will help you stay informed about any further actions required.

- Maintain records: Keep copies of all submitted evidence for your records. This can be useful for future disputes or internal audits.

Example

UrbanGear, an online store, receives a dispute from Chris, a customer claiming that the hiking boots he ordered were never delivered. UrbanGear gathers the shipping receipt, which includes the tracking number and delivery confirmation from the carrier, showing that the boots were delivered to Chris’s address. They use Klarna’s Dispute API to upload these documents as evidence. After reviewing the submission, Klarna resolves the dispute in UrbanGear’s favor, as the evidence clearly supports that the goods were delivered as promised.

Dispute Appeal Process for Partners

1. Dispute Preliminary Outcome

The dispute concludes with a preliminary decision, marked as either favorable to the Partner or not.

2. Eligibility Check for Appeal

It is at Klarna's discretion to determine whether a dispute qualifies for an appeal.

- When dispute is eligible for appeal

- For some dispute cases, Klarna provides the option for an appeal. Instead of closing the dispute immediately, it transitions into the

ARBITRATION_APPEAL_WINDOW_OPENstate, allowing Partners the opportunity to submit an appeal. The general process may look like this:- Day 1 - Dispute open with state

Pre Arbitration - Day 21 - Klarna starts the investigation; state -

Arbitration Pending - Day 22 - Klarna requests the evidence from Partner; state-

Merchant Evidence Pending - Day 25 - Partner responds with evidence; state -

Arbitration Pending - Day 26 - Klarna allows appeal for the dispute; state -

Arbitration Appeal Window Open - Day 30 - Partner Appeal the dispute; state -

Arbitration Pending - Day 33 - Klarna makes the decision on appeal; state -

Closed- Once dispute is closed, klarna will perform the chargeback

- Day 1 - Dispute open with state

- For some dispute cases, Klarna provides the option for an appeal. Instead of closing the dispute immediately, it transitions into the

- When dispute is NOT eligible for appeal

- For certain dispute cases, Klarna does NOT permit an appeal. The general process for these cases may resemble the following:

- Day 1 - Dispute open with state

Pre Arbitration - Day 21 - Klarna starts the investigation; state -

Arbitration Pending - Day 22 - Klarna requests the evidence from Partner; state-

Merchant Evidence Pending - Day 25 - Partner responds with evidence; state -

Arbitration Pending - Day 26 - Klarna makes the decision on dispute; state -

Closed- Once dispute is closed, klarna will perform the chargeback

- Day 1 - Dispute open with state

- For certain dispute cases, Klarna does NOT permit an appeal. The general process for these cases may resemble the following:

3. Appeal Submission Period

- Appeals must be submitted within 10 calendar days of the preliminary dispute outcome, under the

ARBITRATION_APPEAL_WINDOW_OPENstatus. Klarna will automatically close the dispute if the Acquiring Partner or Partner does not appeal the preliminary dispute outcome.

4. Submitting an Appeal

- Partners can submit an appeal with the following:

- A written summary explaining why the preliminary decision was incorrect.

- Identification of any evidence they believe was overlooked in the initial decision. This must be evidence that was already provided; new evidence is not allowed.

- Single challenge limitation: Partner can only appeal the outcome of a dispute once.

Methods of Submission:

Partner portal Disputes App:

- Click the "Appeal" button.

- A modal will appear with questions relevant to the dispute reason and a mandatory field for summarizing Klarna's error in the decision-making.

Klarna Network Disputes API:

- Endpoint: Appeal Dispute decision

- Body: Attachment along with a summary of the perceived mistake in Klarna's initial decision.

Dispute eligible for appeal

5. Appeal Review

- Investigation Process:

- Once the Partner has appealed klarna, dispute state will be transitioned to

ARBITRATION_PENDINGand Klarna service center agents will investigate the dispute again.- Upon submission, the appeal is reviewed by Klarna.

- The SLA for a review is 5 days (max length of appeal is therefore 10 + 5 days)

- If the appeal is successful, the original decision is overturned.

- If unsuccessful, the original decision remains.

- Once the Partner has appealed klarna, dispute state will be transitioned to

Decision-Making:

- If the same decision is upheld, Klarna must state why they believe the decision is still valid.

- If a different decision is made, Klarna must document what was previously missing or misjudged.

6. Monitoring and Controls

- Appeal Monitoring:

- Klarna documents reasons for overturned resolutions to improve the initial resolution process.

- A Partner with more than 30% of their appeals rejected in the past month may be temporarily barred from arbitration.

7. Consequences

- Partners must adhere strictly to the appeal submission guidelines, including the use of initial evidence only.

- Improper challenges leading to a 30% or higher rejection rate result in temporary suspension from the appeal process.

- If a Partner's loss rate for challenged disputes exceeds 30% in the previous month (calculated as the month before the dispute transitions from

ARBITRATION_PENDINGtoARBITRATION_APPEAL_WINDOW_OPEN), they may face a temporary suspension from the Arbitration process for a duration on 1 month. This suspension is triggered as soon as the Partner surpasses the 30% loss rate threshold. To be eligible for this calculation, the Partner must have handled more than 10 disputes in the preceding month. - Disputes that have already transitioned to

ARBITRATION_APPEAL_WINDOW_OPENwill remain eligible for appeal. However, new disputes will not be eligible for the appeal.