Regulated financing promotion rules 101

If you advertise retail credit options which are regulated by the FCA, we recommend that you seek independent legal advice when undertaking any advertising. Using a non-compliant advert can result in enforcement action including fines and the withdrawal of your authorised status from the FCA. Klarna does not accept any liability to Klarna merchants or other third parties for the information contained in this guide. Please keep up to date on the latest updates and changes to the regulations from the relevant authorities, as the information provided in this guide may change.

Klarna’s financing products are regulated credit agreements. Financing falls into two categories, fixed sum credit and revolving credit (also known as running account credit).

Fixed sum credit is a regulated credit agreement with a fixed duration (term). Klarna offers fixed sum credit agreements from 6 months to 4 years. Fixed sum credit can be offered on interest-free or interest- bearing amounts and may incur a default fee if a repayment is missed

Revolving credit is a regulated credit agreement with no fixed duration. This allows consumers to use their account on a rolling basis up to an agreed limit. Revolving credit can be offered with different interest

rates (possibly at 0%) and may include a promotional period for a set period of time. Once this time has passed, if the consumer has not made sufficient repayments over the set period of time the promotion period is offered, any promotional interest rate will revert to Klarna’s standard rate of interest Klarna Financing is a fully-regulated credit product.

This guide has been designed to help you understand the legal requirements when promoting or communicating finance options for consumers.

This guide primarily contains information relevant to our regulated Financing products which are regulated credit agreements (“Financing Products”).

Do you need FCA authorisation as a credit broker?

If you offer our Financing products in the UK, you must obtain a credit broker license from the Financial

Conduct Authority (FCA). A credit broker is a person who carries out certain activities by way of business

in the UK, the most relevant of which are:

- Effecting introductions relating to credit agreements

- Presenting or offering an agreement that would, if entered into, be a regulated agreement

- Assisting with preparatory work relating to entering into a regulated credit agreement

- Entering into a regulated credit agreement on behalf of a lender.

If you carry out any regulated activities without first being authorised by the FCA then you may be

committing a criminal offence.

If you only offer BNPL Products products then you do not require a credit broker authorisation from the FCA. Any advertisements would, however, need to be approved by Klarna before published to a UK audience.

The rules applicable to advertising in the UK are found in both legislation and in self-regulatory industry codes of practice. The following authorities are responsible for regulating the advertising/financial promotion and communication with a consumer.

The Financial Conduct Authority (FCA)

The main aim of the FCA is to ensure that financial markets function well. In order to achieve this, it has three operational objectives which are to:

- Secure an appropriate degree of protection for consumers

- Protect and enhance the integrity of the UK financial system; and

- Promote effective competition in the interests of consumers

It is committed to ensuring the consumer credit market works well and that customers are treated fairly.

The FCA's Principles for Business (the Principles) and Consumer Credit Sourcebook (CONC) govern financial promotions issued, distributed or communicated by authorised credit broking firms to consumers.

The Advertising Standards Authority (ASA)

The ASA is the UK’s advertising regulator and is responsible for applying the Advertising Codes (the UK Code of Non-broadcast Advertising and Direct & Promotional Marketing and the UK Code of Broadcast Advertising) written by the Committee of Advertising Practice (CAP) and Broadcast Committee of Advertising Practice (BCAP). These apply to all UK firms.

| ASA Powers | FCA Powers |

|---|---|

The ASA considers all complaints about non-technical aspects of advertisements in non-broadcast media. For example, offence, social responsibility, fear and distress and competitor denigration. The ASA also assesses complaints about broadcast advertisements and liaises with the FCA on technical matters, as appropriate. The ASA investigates general advertisingcomplaints and can:

| The FCA monitors and investigates compliance with the Principles, CONC and its other rules generally and has a variety of powers, including swift direct intervention with firms to force the immediate amendment or withdrawal of financial promotions which contravene its financial promotion rules under section 137S of the FSMA. The FCA also has the power to, amongst other things:

|

As the FCA does not pre-approve promotions, it is incumbent on senior management of those firms making such promotions to make sure they remain compliant.

Other guidelines that apply to financial promotions.

Financial promotions are subject to a variety of laws and rules, some of which we consider in this guide alongside the detailed CONC requirements, which may include:

- Consumer Protection from Unfair Trading Regulations 2008 – set out the commercial practices, of which advertising is one

- Business Protection from Misleading Marketing Regulations 2008

- Consumer Rights Act 2015

For regulated credit products. Financial promotions may contravene the FCA’s ‘clear, fair and not misleading’ rules if they omit relevant risk warnings.

Examples of relevant risk warnings for regulated products include:

- Late or missing repayments may have serious consequences for you and cause you serious money problems.

- Your credit rating may be affected which will make it more difficult or more expensive for you to obtain credit in the future.

- Outlined below are our recommended disclosures for your advertising of Klarna's Financing products. Please ensure you apply the correct disclosure for your situation.

REMEMBER that you must always add a risk warning.

[Merchant’s legal entity name and postal address (as it appears on the FCA Register)] is authorised and regulated by the Financial Conduct Authority ("FCA") (FCA FRN XXXXX) and acts as a credit intermediary and not a lender, offering credit products provided exclusively by Klarna Financial Services UK Limited (company number 14290857), which is authorised and regulated by the FCA by the FCA for carrying out regulated consumer credit activities (firm reference number 987889), and for the provision of payment services under the Payment Services Regulations 2017 (firm reference number 987816). Finance is only available to permanent UK residents aged 18+, subject to status, T&Cs apply. Klarna.com/uk/terms-and-conditions

[Insert postal address of the firm making the financial promotion if required*]

Remember to always add an appropriate risk warning to the promotion which needs to be prominently displayed above the disclosure and near to the benefits being promoted.

[Merchant’s legal entity name and postal address (as it appears on the FCA Register)] is authorised and regulated by the Financial Conduct Authority ("FCA") (FCA FRN XXXXX) and acts as a credit intermediary and not a lender, offering credit products provided by a limited number of finance providers, including Klarna Financial Services UK Limited (company number 14290857), which is authorised and regulated by the FCA for carrying out regulated consumer credit activities (firm reference number 987889), and for the provision of payment services under the Payment Services Regulations 2017 (firm reference number 987816).

[Insert postal address of the firm making the financial promotion if required*]

Remember to always add an appropriate risk warning to the promotion which needs to be prominently displayed above the disclosure and near to the benefits being promoted.

[Merchant’s legal entity name and postal address (as it appears on the FCA Register)] is authorised and regulated by the Financial Conduct Authority (FCA FRN XXXXX) and acts as a credit intermediary and not a lender, offering credit products provided [exclusively by Klarna Financial Services UK Limited] [by a limited number of finance providers, including Klarna Financial Services UK Limited]. Please note that [Pay in 3 instalments] [and] [Pay in 30 days] agreements are not regulated by the FCA. Finance is only available to permanent UK residents aged 18+, subject to status, T&Cs and late fees apply. Klarna.com/uk/terms-and-conditions

[insert postal address of the firm making the financial promotion if required*]

Remember to always add an appropriate risk warning to the promotion which needs to be prominently displayed above the disclosure and near to the benefits being promoted.

Klarna’s [Pay in 3 instalments] [and] [Pay in 30 days] are unregulated credit agreements.Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

Remember to always add an appropriate risk warning in the disclosure which needs to be prominently displayed above the disclosure and near the top the benefits being promoted.

Be careful when using these phrases in your advertising of Klarna's regulated Financing products

“Overdraft”, must not be used, unless you are offering a running-account credit agreement which enables a consumer to overdraw on a current account

“Interest free”, or any similar expression, must not be stated unless the total amount payable does not exceed the cash price

“No deposit”, can only be used where there are no advance payments to be made

“Gift”, “present”, or any similar expression can only be used where there are no conditions which would require a consumer to repay the credit or return the item that is the subject of the claim

“Weekly equivalent” or any similar expression or other periodical equivalent, unless weekly repayment or the other periodical payments are provided for under the agreement

When a financial promotion must include a representative APR.

Unless the representative APR is 0%, the representative APR will need to be clearly displayed within the example. The representative APR must also be shown when a financial promotion:

- States or implies that credit is available to persons who might consider their access to credit restricted

- Includes a favourable comparison relating to the credit, whether express or implied, with another person, product or service; or

- Includes an incentive to apply for credit or to enter into an agreement under which credit is provided (e.g. the speed or ease of processing the application, considering or granting an application, or making funds available to apply for credit or enter into a credit agreement etc.)

The content of your promotion will determine whether the representative APR can be shown in isolation or whether it must be shown as part of the ‘representative example’.

The representative APR is the APR at or below which you reasonably expect, at the date on which the promotion is communicated, that credit would be provided under at least 51% of the credit agreements which will be entered into as a result of the promotion. In other words, the % APR that consumers are most likely to be approved for, should be used as your representative APR.

A representative APR must be shown as a % APR’ and used with the word ‘representative’. Where a representative APR is subject to change it must be accompanied by the word “variable’’.

It should be noted that the representative APR must be given no less prominence than any of the other matters referred to in this guide (e.g. an inducement or an incentive to apply for credit etc.).

The annual percentage rate of charge is calculated in accordance with the mathematical formula set out in CONC.

Triggers for showing representative APR

- Our lowest rates ever

- Been refused for credit?

- Apply for credit today and get a free pen

- Simple, quick and easy credit - why wait? Apply now!

- Get 10% discount on any credit purchase if you apply before 31st March

Does not trigger the need to show a representative APR

- We offer efficient friendly consumer service

- We act as a credit broker not a lender

Where a financial promotion includes a rate of interest (excluding the representative APR) or an amount relating to the cost of credit it must include a ‘representative example’, and specify a postal address of the firm making the financial promotion (i.e. the postal address of the merchant). A rate of interest for this purpose is not limited to an annual rate of interest and would include a monthly or daily rate or an APR. An amount relating to the cost of credit would include the amount of any fee or charge, or any repayment of credit (where it includes interest or other charges).

It should be noted that a firm making the financial promotion does not need to specify a postal address when the promotion is being communicated by television or radio broadcast, or is on the firm’s premises, unless the promotion is made in writing which the consumer can take away.

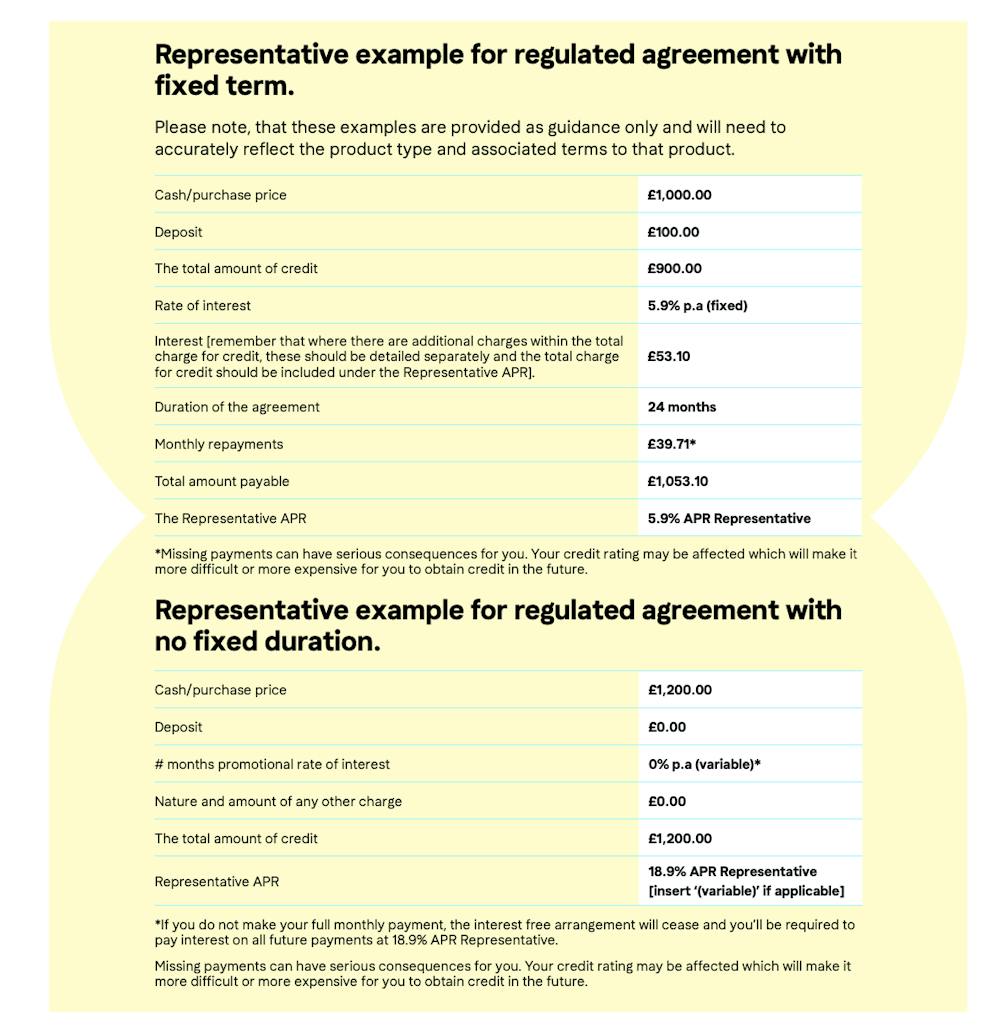

The representative example must comprise the information listed in the standard information as shown on the following page and must be accompanied by the words ‘’representative example’’. It must be representative of agreements to which the representative APR applies and which are expected to result from the advertisement.

The representative example is unlikely to be representative if, for example, most consumers entering into agreements as a result of the financial promotion are likely to do so for a lower amount of credit than that indicated in the example, or with higher rates of interest or other charges than those indicated in the example.

A representative example MUST also include all of the following for a fixed sum regulated credit agreement (fixed duration):

- The rate of interest and whether it is fixed or variable or both, expressed as a fixed or variable percentage applied on an annual basis to the amount of credit drawn down

- The nature and amount of any other charge included in the total charge for credit

- The total amount of credit

- The representative APR

- In the case of credit in the form of a deferred payment for specific goods, services or other things, the cash price and the amount of any advance payment

- The duration of the agreement

- Total amount payable; and

- The amount of each repayment of credit

The information contained in a representative example must be:

- Specified in a clear, concise and prominent way

- Accompanied by the words “representative example”

- Presented together, with each item of information being given equal prominence

And given no less prominence than:

- Any other information relating to the cost of credit in the financial promotion; and

- Any indication or incentive encouraging the consumer to apply for credit

Guidance on total charge for credit

The total cost of credit represents the true cost to the borrower of the credit provided, or to be provided, under a regulated credit agreement and includes fees and/or charges payable by the consumer to a credit broker.

Guidance on the total amount of credit

The total amount of credit equates to the sum available to the consumer to use under the credit agreement (i.e. the credit limit) and does not include charges which are financed by the credit agreement; those are part of the total charge for credit.