In this article, you will be informed about the merchant Dispute fees and when they are applicable.

When a customer raises a dispute with us for the reasons set forth below, you (as the seller of the goods/intangible goods) are responsible for resolving this dispute. If you cannot reach an agreement with the customer within the time period specified below depending on the dispute reason, we will start the investigation and our Dispute Resolution team will step in and help solve the dispute. This will change the status to ´Investigation started´. In such a case, we reserve the right to charge you a dispute fee to compensate for additional operational costs on our side.

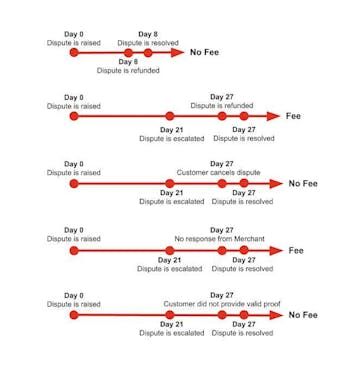

Whether you get charged with a Dispute fee or not is decided by the outcome of the dispute, not the escalation in itself, hence we do not charge a Dispute fee on the day of escalation. The fee is charged retroactively once we have determined the outcome of the dispute and who is liable.

You will not be charged a Dispute fee if a customer:

- Is deemed to be at fault.

- Cannot provide the information requested by Klarna to proceed.

- Cancels the dispute on their own accord.

In these instances, we will reactivate the payment with no charge towards you.

Contingent on the customer providing Klarna with the relevant information to proceed with the dispute.

Counting from when the dispute is raised by a customer with Klarna, you and the customer have a minimum of 21 days to resolve the dispute, as stated below. The one exception being returns, where we count from the return date.

With that in mind, if you do not resolve a dispute within the time periods stated below, starting from when the Customer opens the dispute with Klarna, we may charge you a Dispute fee.

| Dispute reason | Calendar Days |

|---|---|

| Returns | 21* |

| Goods not received | 21 |

| Incorrect Invoice | 21 |

| Faulty Goods | 21 |

| Already paid | 21 |

| Unauthorized purchases | 0 |

* Depending on the return date provided by the customer upon Klarna’s request. If the return date is <21 days from escalation we will automatically postpone the escalation date by 21 days from the return date, giving you enough time to be able to process the return.

You will find your disputes under the tabs "Open disputes" and "All disputes" in Klarna Merchant Dispute App.

- "Open disputes" - Contains all disputes with the status "Investigation started´, meaning disputes that have passed the Resolution time and may be charged with a Dispute fee.

- "All disputes" - Contains all disputes. Recently opened, escalated and closed going back 180 days.

To help you manage your disputes and make sure you do not miss a deadline, Klarna will notify you shortly after the investigation was started from Klarna (status `Response required´) and is available in `Open disputes´.

There are two types of Dispute fee structures:

The fee increases if the amount of escalated disputes relative to the amount of captures generated is deemed as excessive for a pre-set period:

- Merchants will be charged the excessive dispute fee if their dispute escalation rate exceeds 1.5% for at least 3 consecutive months, during which time such merchants have processed over 100 orders.

- Merchants will be moved back to the standard dispute fee if their dispute escalation rate falls under 1.5% for at least 3 consecutive months.

- For those merchants that have several MIDs, please note that the dispute escalation rate is measured on a MID level rather than as an average across all MIDs. This means that if you have more than one MID, the dispute fee applicable to each MID may vary based on how each MID performs individually.

If applicable to you as detailed further below, we will start charging this fee type.

You are charged a flat fee regardless of how many disputes escalate on a monthly basis relative to the amount of orders you generate.

Eventually, we will only have one dispute fee type, in line with the structure and pricing of the Type 1 dispute fee.

More information regarding which Dispute fee and structure applies to you, below.

Merchants that onboarded and processing transactions with Klarna Payments, Klarna Checkout or that are offering Klarna through our Plugins for e-commerce platforms, Payment Service Provider or other Klarna Partner.

| Market | Standard Fee | Excessive Fee |

|---|---|---|

| AT, DE, ES, IT, FR, BE, NL, IE, FI, PT, GR | EUR 15 | EUR 30 |

| SE | SEK 150 | SEK 300 |

| NO | NOK 150 | NOK 300 |

| DK | DKK 150 | DKK 300 |

| UK | GBP 10 | GBP 20 |

| PL | ZL 60 | ZL 120 |

| US | USD 15 | USD 30 |

| CA | CAD 20 | CAD 40 |

| AU | AUD 25 | AUD 50 |

| NZ | NZD 25 | NZD 50 |

| CZ | CZK 350 | CZK 700 |

| RO | RON 70 | RON 140 |

| CH | CHF 15 | CHF 30 |

| MX | MXN 125 | MXN 250 |

For transactions in any market not listed above, the Dispute fee will be SEK 150 (Standard fee) or SEK 300 (Excessive fee).

Other merchants

| Market | Dispute fee |

|---|---|

| AT, DE, ES, IT, FR, BE, NL, IE, FI, PT, GR | EUR 7.50 |

| SE | SEK 75 |

| NO | NOK 75 |

| DK | DKK 75 |

| UK | GBP 6 |

| PL | ZL 30 |

| US | USD 8 |

| CA | CAD 11 |

| AU | AUD 12 |

| NZ | NZD 12 |

| CZ | CZK 150 |

| RO | RON 35 |

| CH | CHF 7.50 |

| MX | MXN 7.50 |

For transactions in any market not listed above, the Dispute fee will be SEK 75.

Once the investigation is over and all sides have been considered, the dispute is closed. It is at this point that the Dispute fee is applied, based on the Closing Reason.

Below you will find a breakdown of the Closing Reasons and which result in a Dispute fee being charged in accordance with the conditions set forth in the agreement and specified above.

| Closing reason | Dispute fee |

|---|---|

| Customer_did_not_provide_enough_details | No |

| Customer_did_not_provide_valid_proof | No |

| customer_did_not_reply_to_request | No |

| Closing reason | Dispute fee |

|---|---|

| customer_cancelled_dispute | No |

| merchant_provided_valid_shipping_details | No |

| merchant_informed_about_invalid_return | No |

| merchant_informs_that_invoice_is_correct | No |

| merchant_has_not_received_payment_or_payment_to_3rd_party | No |

| merchant_has_refunded_payment_to_customer | Yes |

| merchant_solved_the_dispute_with_the_customer | No |

| merchant_informed_about_invalid_dispute | No |

| reactivated_invoice_statement | No |

| fully_paid_prior_to_escalation | No |

| fully_paid_after_escalation | No |

| refund_issued_by_merchant_after_escalation | Yes |

| incorrect_payment_details_used_refunded | No |

| klarna_resolved_due_wrong_dispute_reason_chosen | No |

| dispute_opened_under_wrong_dispute_reason | No |

| merchant_has_refunded_payment_to_klarna | No |

| dispute_automatically_closed | No |

| fully_paid | No |

| klarna_resolved_dispute_in_merchant_favor | No |

| Closing reason | Dispute fee |

|---|---|

| merchant_did_not_reply_to_dispute_request | Yes |

| merchant_did_not_follow_klarnas_shipping_policy | Yes |

| incorrect_invalid_delivery_in_physical_store | Yes |

| service_digital_goods_klarna_does_not_take_risk | Yes |

| merchant_did_not_adjust_statement_on_klarnas_request | Yes |

| merchant_did_not_perform_promised_refund | Yes |

| could_not_send_another_request | Yes |

| merchant_accepted_the_loss | Yes |

| shipped_to_non_approved_address | Yes |

| merchant_did_not_follow_klarnas_return_policy | Yes |

| goods_sent_without_tracking_number | Yes |

In order to uphold transparency, we are dedicated to providing you with clear and accessible communication regarding the resolution of disputes. This includes sharing the reason behind the closure of a dispute. Below you will find a view of what is displayed in the Merchant Dispute App when a fee has been applied.

In the Dispute detail page we communicate

- Closed on - Date and time when the dispute was closed

- Status - Outcome of the dispute

- Reason - Closing Reason explaining why the outcome was reached

- Chargeback amount - Amount chargebacked on the order, whether partial or full (if merchant lost)

- Dispute fee - displayed if dispute was charged with a Dispute fee

In the example provided, the dispute was ultimately lost because the merchant failed to respond to the request before the deadline, as stated in the ‘Reason’ field. As a result, the status of the scenario was updated to ´Merchant lost´. This led to a chargeback and a Dispute fee of EUR 7.50.

Below you will find an example of how the Dispute fee is reported in the Settlement report.

For more information about the Settlement Report, please see Settlements in docs.klarna