Add an external payment method or external checkout into the KCO iframe.

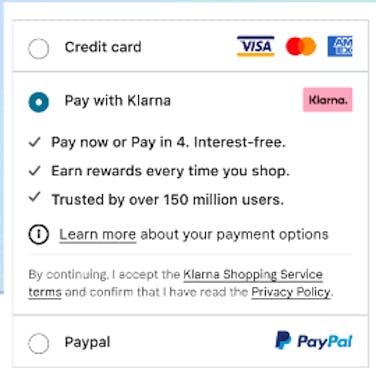

External payment methods and checkouts allow merchants to offer payment methods not available today as an inline experience with KCO.

When users choose an external payment method they will be redirected to a link provided by the merchant and operated by the merchant.

You can find the implementation guides and requirements for these two types of integrations below.

Note: If you are interested in adding an external payment method or external checkout, please reach out to your account manager to make sure it is included in the commercial contract and is approved before going live.

Add external payment methods apart from Klarna.

When the Checkout is loaded, you have the option to load external payment methods into KCO. The customer will still fill out address information in KCO, but when choosing an external payment method they will be redirected to the URL you have provided. The user will finalize the purchase at that page.

Note: You are responsible for the completion of the purchase flow when a user has chosen an External Payment Method including e.g. an order summary page, a order confirmation page and reconciliation of orders.

You need to utilize external_payment_method to make sure that they appear in all payment flows. You must add all necessary information, including information to be displayed in relation to the payment method and redirect URIs, in this object when loading KCO.

KCO will redirect the user to the added URI when they have selected the payment method and clicks “Continue”. You will have to integrate the purchase flow following this step to enable completion of an order.

Note: Integrating external payment methods requires additional integration work, since this payment method will be processed and finalized outside KCO. You will thus need to cater for some of the payment flows, both frontend and backend. As well as ensure that your checkout is compliant. See examples of additional integration steps below:

- Since external payments take place outside KCO, no user data will be shared for this purchase to you, the merchant. Klarna has no involvement in the integration towards any third party provider.

- You/the external payment method will need to cater for that so all relevant user data to finalize the purchase (e.g. address, name, etc.) is stored securely.

- Please note that in the case of external payment methods, you or the third party provider will need to host your own pages to make the purchase flow compliant. Including e.g. order confirmation page, order summary page and buy button.

- New backend integration towards the external payment method will be required.

- Given that this is an external payment, Klarna’s buyer protection will not apply for your consumers. We advise that you mention that this is an external payment method in the payment method description.

- Showing external payment methods in the checkout require a contract agreement, please reach out to your key account manager for more information.

The payment methods are defined when calling the KCO. The payment methods will be presented in the checkout in the order they are set in the API call, after the default options provided by Klarna.

"external_payment_methods": [

{

"name": "Cash on delivery", // Mandatory

"redirect_url": "https://…", // Mandatory. HTTPS. Page for completing the purchase.

"image_url": "https://…", // Optional. HTTPS. Exact size: 69x24px

"fee": 1450 // Optional fee added to the order.

"description": "Lorem.." // Optional. 500 character limit. Links can be set with the Markdown syntax [Text](URL)

}

]

KCO supports a wide range of external payment methods in KCO. The following list displays all of the external payment methods we currently support:

Note: The name is case sensitive and must be used in exactly the way it’s mentioned in this list. (e.g. “Paypal” won’t work but “PayPal” does).

| Name | Primarily used in |

|---|---|

| Achteraf betalen | NL |

| Alipay | Global |

| Amazon | Global |

| Amazon Pay | Global |

| Amex | Global |

| Apple Pay | Global |

| Bancontact | BE, NL |

| Bank Transfer | Global |

| Bankoverførsel | DK |

| Banköverföring | |

| Barzahlen | DE, AT |

| Barzahlung Bei Abholung | |

| Bedriftsfaktura | NO |

| Betal i butikk | |

| Betal på verkstedet | |

| Betala i butik | SE |

| Betala på plats | |

| Betala på station | |

| Betalning på betjäningsstället | |

| bitcoin | Global |

| Bonifico Bancario | IT |

| Bussiennakko | FI |

| Business Invoice | |

| Card via PayPal | US |

| Carte Bancaires | FR |

| Carte Bleue | FR |

| Cash on Delivery | Global |

| Cash on Hand | Global |

| ClickandBuy | DE, AT |

| CoinPayments | Global |

| Coop Matkonto | |

| Dankort | DK |

| Consors Finanz | DE |

| Delbetal i ditt eget tempo | NO |

| Delbetalning | SE |

| Diners/Discover | |

| Divide.Connect | |

| EAN Fakturering | DK |

| Easy Dibs | SE |

| EU- standaard bankoverschrijving | NL |

| EU-Standard Bank Transfer | |

| Ennakkomaksu | FI |

| Faktura | SE |

| Faktura 14 dagar | SE |

| Faktura 14 dage | DK |

| Fast delbetaling | SE |

| Forskudd | NO |

| Företagsfaktura | SE |

| Förskottsbetalning | SE |

| Gavekort | NO |

| Giropay | DE, AT |

| Google Wallet | Global |

| iDeal | NL |

| Konto | |

| Kort | |

| Kortti | FI |

| Kreditkarte | DE, AT |

| Lasku 14 päivää | FI |

| Lastschrift | DE, AT |

| M-Cash | |

| Maksu noudon yhteydessä | FI |

| Maksu liikkeessä | FI |

| Maksu palvelupisteellä | FI |

| MobilePay | |

| Multibanco | |

| Nachnahme | DE, AT |

| Pagamento Alla Consegna | IT |

| Partner | |

| Pay at office | FI |

| Pay at station | |

| Pay by Card or PayPal | US |

| Pay in-store | |

| Paydirekt | DE, AT |

| PayPal | Global |

| PayPalExpress | US |

| Postförskott | SE |

| Postiennakko | FI |

| Postoppkrav | NO |

| Sagepay | |

| SOFORT Überweisung | |

| Strix | |

| Transferencia Bancaria | Global |

| Lasku | FI |

| Verkkomaksu | FI |

| Vipps | NO |

| Virement bancaire | FR |

| Vorkasse | DE, AT |

| Vorkasse Banküberweisung | DE, CH |

| Wire Transfer | Global |

| Zahlung bei Abholung | Zahlung bei Abholung |

| 銀行振込 | JP |

To be compliant, you need to have an agreement between you and the external payment method providers (e.g. Paypal). This does not apply if you are providing the method yourself (e.g. Vorkasse).

When the Checkout is loaded, you have the option to load additional payment methods as external checkouts, such as “Wallets". Payment Methods integrated as External Checkouts in KCO are shown as buttons in the bottom of KCO and available from the moment KCO loads. When a user clicks on one of these Express Checkout buttons, they will be redirected to the URI you have added to the button, where they will complete the purchase, e.g. to Paypal.

Please note that when a consumer is using a payment method not offered by Klarna, no purchase order is created by Klarna. Klarna doesn’t know whether the consumer eventually finishes the purchase after leaving the checkout. Klarna doesn’t send any kind of confirmation emails or handle any money. All processing of the order is the merchant’s responsibility.

For External Checkouts, you don’t need KCO to collect data about the consumer (e.g. Paypal).

Note: For PayPal you have to configure external_checkout to make sure that they appear in all payment flows. You are responsible for the completion of the purchase flow including the e.g. address collection and confirmation page.

- Since External Checkouts take place outside KCO, no user data will be shared for this purchase to you, the merchant. Klarna has no involvement in the integration towards any third party provider.

- You/the external payment method will need to cater for that so all relevant user data to finalize the purchase (e.g. address, name, etc.) is stored securely.

- Please note that in the case of external payment methods, you or the third party provider will need to host your own pages to make the purchase flow compliant. Including e.g. order confirmation page, order summary page and buy button.

- New backend integration towards the third party payment provider will be required.

- Given that this is an external payment, Klarna’s buyer protection will not apply for your consumers.

"external_checkouts": [

{

"name": "Non Klarna eWallet", // Mandatory

"redirect_uri": "https://…", // Mandatory. HTTPS. Page for completing the purchase.

"image_uri": "https://…", // Mandatory. HTTPS. Exact size: 276x48px

"fee": 1450 // Optional fee added to the order.

}

]

KCO supports a wide range of external checkouts in KCO. The following list displays some of the external payment methods we support:

Note: The name is case sensitive and must be used in exactly the way it’s mentioned in this list. (e.g. “Paypal” won’t work but “PayPal” does).

| Name | Primarily used in |

|---|---|

| Amazon Pay | Global |

| Amex | |

| Bank Transfer | |

| Barzahlen | DE, AT |

| Cash on Hand | |

| ClickandBuy | |

| CoinPayments | |

| Giropay | DE, AT |

| Google Wallet | |

| Kreditkarte | DE, AT |

| Lastschrift | DE, AT |

| M-Cash | |

| MobilePay | |

| Nachnahme | DE, AT |

| Partner1 | |

| PayPal | Global |

| Postförskott | SE |

| Postiennakko | FI |

| Postoppkrav | NO |

| Strix | |

| Vipps | |

| Vorkasse | DE, AT |

| Wire Transfer | |

| Zahlung bei Abholung | DE, AT |

To be compliant, you need to have an agreement between you and the external payment method providers (e.g. Paypal). This does not apply if you are providing the method yourself (e.g. Vorkasse).

To be compliant, you have a contractual obligation to have an agreement between you and the external payment method providers (e.g. Vipps and Paypal).

To simplify your bookkeeping, Klarna wants to provide a complete reporting offering.

However, as Vipps has a slightly different setup compared to our other available payment methods you will need to do some changes in your reconciliation process.

What separates Swish from our other payment method is that the money from a Vipps transaction will be paid out immediately and separately compared to Klarna’s aggregated payout.

Reconciliation of Vipps transactions will require new variables to be included in your settlement reports.

Settled by:

Klarna - Paid out by Klarna

Vipps as an External Payment Method - Paid out by Vipps

External reference

The reference that will appear on your bank account, set and controlled by Vipps.

Klarna reference

A reference number that Klarna sets and controls. This may may or may not appear on your bank account depending on which bank you are using.

Reconciliation of Vipps transactions will require new transaction types to be included in your settlement reports.

External payout capture

Represents the transfer of money from consumer to merchant through Vipps scheme upon purchase completion in the checkout

External payout refund

Represents the transfer of money from merchant to consumer through Vipps scheme upon return/chargeback/refund

External payout retransfer

In the case where a consumer switches payment method after the order has been activated, External payout retransfer represents the shift of responsibility for the payout from Klarna to Vipps. This transaction type will deduct money from the payout from Klarna, as money has already been transferred through the Vipps schemes.

External payout reactivation

Since capture is only concerning money transfer, and External payout retransfer fully undoes the previous activation; External payout reactivation represents the activation (shipment) of the good whereas External payout capture only represents the transfer of funds.

Please be advised that for transactions where Vipps was selected as a payment method, Klarna can not guarantee that this transaction has an invoice number. As invoice numbers are created upon activation, some transactions that haven’t been activated yet will be included in the settlement report.

We recommend matching the non-Vipps transactions in the same way as you currently do it.

For Vipps transactions, you can link the external reference to the order ID set by you in your ERP. You can use the invoice number in the cases you have that in the settlement report, but to keep things consistent Klarna recommends you to reconcile based on your order ID. When reconciling your bank statement, simply identify the paid orders using the external reference and reconcile these in your system.