Unauthorised Partners (i.e. Partners that are not authorised by the FCA) that communicate Financial Promotions without approval by Klarna are at risk of committing a criminal offence. Learn more.

Only pre-approved downloaded assets or Klarna On Site Messaging will be deemed approved by Klarna. If you amend any wording or use your own bespoke assets, your promotion does not have Klarna’s approval and you will be required to remove or update non-compliant Financial Promotions in order to avoid:

1) breaching your contractual obligations with Klarna; and

2) committing a criminal offence.

Partners that do not take the action requested to remedy a non-compliant Financial Promotion may have their payouts terminated and Klarna reserve's its right to terminate its contract with you.

Extra rules apply when you advertise Klarna’s longer term Regulated Financing options. If you offer Klarna’s regulated financing, you must use the Regulated Financing Guidelines.

Partner marketing that does not comply with these rules will not be approved by Klarna.

Klarna offers two different Buy Now Pay Later credit products in the UK (BNPL products):

- Pay in 3 instalments allows a consumer to spread the cost over 3 equal payments. This product is completely interest-free.

- Pay in 30 days allows a consumer to get up to 30 days to pay for their goods with no interest.

When advertising Klarna's BNPL products you MUST follow the following Rules for your advert to be compliant with the laws around advertising credit in the UK, and therefore approved by Klarna. If you amend any wording or do not follow our Financial Promotions Rules, your promotion will not be approved by Klarna’s. These rules must be followed by all Partners who market our BNPL products in the UK.

Remember that if you are not authorised by the FCA you are at risk of breaching the Financial Promotion Restriction if you communicate Financial Promotions without approval. Learn more.Learn more.

Messaging that promotes the benefit of using Klarna's BNPL product should also highlight the possible risks by including the UK BNPL Disclosure within the promotion.

Why do I need a disclosure on my marketing?

Whilst the BNPL product remains unregulated in the UK, the advertising of them is subject to the Financial Conduct Authority’s regulatory requirements. At the centre of these is the need to ensure communications about BNPL give customers everything they need to know before they decided to use credit to make their purchase. Partners must ensure adverts are balanced and do not emphasises the potential benefits of a product or service without also giving fair and prominent indication of any relevant risks.

What is a disclosure?

A disclosure is required to be added on BNPL product promotions so that consumers understand the nature and features of the BNPL product they are using.

What is a risk warning?

A risk warning forms part of the disclosure and should be presented closely together with any benefits being promoted. Risk warnings highlight the possible negative consequences of a purchase or (mis)use of a product and provide information that ideally helps a potential customer to weigh up whether the product is suitable for them.

For example, the risk warning in our disclosure is this part:

Klarna's Pay in 3 is an unregulated credit agreement. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit.

Klarna's BNPL disclosure

To deal with these requirements, and to ensure customers understand the product, it is essential that any advertising that is promoting the benefits of BNPL products includes the UK BNPL Disclosure. The disclosure is designed to provide key information to the customer about the product as well as the all important risk warnings.

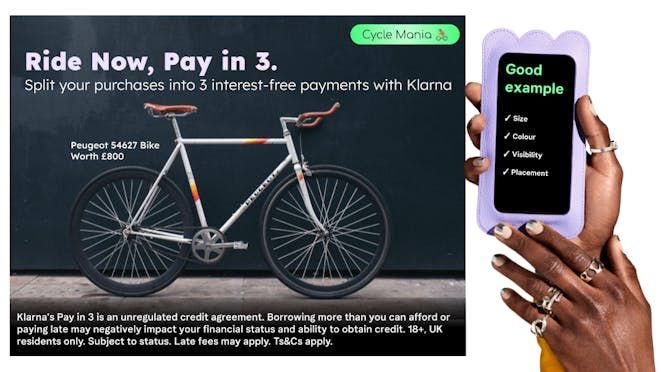

In any marketing it is important to always be clear with customers. This however becomes especially important in relation to the BNPL disclosure. You must ensure that the UK BNPL disclosure is prominent enough to meet the FCA's requirements.

This means:

1. In relation to the other content of the marketing asset;

2. The disclosure is prominent enough (in time shown, size, clarity and colour);

3. In such a way that is likely that the attention of the average consumer would be drawn to it.

The most important things to remember are:

- SIZE (your disclosure size should be at least 50% the size of the invitation to credit / promotion of BNPL)

- COLOUR (your font colour should be WHITE if the background is dark, or BLACK if the background is light)

- VISIBILITY (your disclosure must not be laid over busy imagery / pattern / other markings that makes the text less visible)

- PLACEMENT (your disclosure should be placed WITH the invitation to credit / other promotion and as a general rule should always be visible on the same screen without the need to scroll).

READ TIME (for video content, the disclosure must be on the screen for a minimum of 8 seconds to enable it to be readable)

Prominence rules:

SIZE at least 50% + COLOUR (white on dark) OR (black on light) + VISIBLE + PLACED with Invitation to Credit

An invitation to credit prompts or encourages a consumer to use a BNPL product.

The UK law does not define the term "invitation" but they are interpreted widely. The UK regulator’s view is that "the expressions 'invitation' or 'inducement…suggests any communications which have a promotional element.."suggests any communications which have a promotional element.."promotional element.'."

Due to the wide interpretation of ‘invitation to credit’, it is important to consider whether the overall impact of your advertising is to promote a BNPL product. If it is, you will need to observe these RULES for advertising BNPL.

No disclosure:

If you use one of the four PRE-APPROVED prompts below, it is not a Financial Promotion and no disclosure is required:

- “Klarna available”.

- “Klarna available at checkout”.

- "Pay with Klarna".

- “Choose how to pay with Klarna”.

- [Image of Klarna logo].

Disclosure required:

Below is a list of PRE-APPROVED invitations to credit that will trigger the need to add the BNPL disclosure.

- “Get more time to pay with Klarna”

- “Pay in 3 with Klarna”

- “Split your purchases into 3 interest-free payments”

- “Shop now. Pay in 30 days with Klarna”.

- “Shop now. Pay over time with Klarna”

- “Shop now. Pay with Klarna.”

- “Flex your payments.”

- “Pay Instore with Klarna”.

If you choose to use these options these are "Invitations to Credit" prompts and therefore require the disclosures and risk warnings outlined below.

- Disclosures should be positioned horizontally.

- Full terms and conditions should be no more than one click away.

- Risk warnings should not be less prominent than any wording about the potential benefits of the product.

- Always provide a link to our terms and conditions or display the full URL klarna.com/uk/terms-and-conditions

Social media disclosure placement tips

- Instagram feed - Include in the image or in text. Not buried within or under multiple hashtags. If you cannot provide a link in your bio for T&Cs then use the full URL in your post: klarna.com/uk/terms-and-conditions.

- Instagram stories - Include disclosure in images.

- Twitter - Avoid placing disclosures in an image.

- Google ad - Disclosure can be at the end of text.

- Banners - Dynamic/carousel banners may include disclosure in the final frame.

- Email CRM - Include the disclosure / risk warning next to the invitation to credit or any wording about the potential benefits.

Below we have provided the appropriate disclaimer for a selection of common marketing channels in which you might promote Klarna and its products. Please copy the text, replacing the elements in bold which apply to your company and the Klarna products featured in the promotion. Remember, if you are using Klarna Brand BNPL Messaging with no specific product referenced, you will need to include every Klarna BNPL product that you offer.

Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply. klarna.com/uk/terms-and-conditions

Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

Please include this disclosure underneath your post:

Klarna's Pay in 3 / Pay in 30 days are unregulated credit agreements. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Ts&Cs and late fees apply.

Klarna's [Pay in 3] [Pay in 30] is an unregulated credit agreement. Borrowing more than you can afford or paying late may negatively impact your financial status and ability to obtain credit. 18+, UK residents only. Subject to status. Late fees apply. By continuing I accept the https://cdn.klarna.com/1.0/shared/content/legal/terms/0/en_gb/pay_after_delivery/ Pay Later Terms https://cdn.klarna.com/1.0/shared/content/legal/terms/0/en_gb/slice_it_card/ Pay in 3 terms.

Limited space disclosures

- 18+, T&C apply, Credit subject to status.

- Please spend responsibly. 18+, T&Cs apply. Tap the link for more info.

- 18+, T&C apply, Credit subject to status. Learn more.

If you are not authorised by the FCA, or using Klarna's OSM your advert MUST have Klarna's approval to avoid committing a criminal offence.

Are you advertising Pay in 3 or Pay Later in 30 in the UK? ☑️

Does your ad include an “invitation to credit”? ☑️

If so, you MUST:

- Use Pre-Approved prompts only

- Make it clear that Klarna is a form of credit.

- Warn customers about the risks of taking out credit

- Include a disclosure

- Follow our Prominence Rules

- Follow our Placement Rules

- Follow our Anti-Greenwashing Rules

If yes, SUBMIT YOU ASSET FOR APPROVAL BY KLARNA.

If in doubt, use Klarna On-site messaging.

It is your responsibility to understand and comply with Advertising Standards in your ads.

DO NOT target under 18s, those with debt problems, or any other vulnerable group in any ad mentioning Klarna.

DO NOT mention the speed or ease of using Klarna.

DO NOT mention any of the following in any ad that mentions Klarna:

- Gambling

- Criminal activity

- Overtly sexual material

- Payday lending

- Overspending

- Unmanageable debt

DO NOT make claims about Klarna's credit products being sustainable.

Avoid making claims relating to:

- The Environment

- Climate or climate change

- Sustainability / sustainable

- Bioiversity and nature

- Social issues

- Corporate social responsibility