Help customers complete payments securely by handling Klarna’s step-up authentication using the purchase journey. This guide breaks down how to integrate and respond when a step-up flow is triggered by Klarna’s Payment Authorize API.

Integration overview

When Klarna requires additional verification from the customer (e.g., login, authentication, or payment method selection), it returns a Payment Request in the response to the Payment Authorize API call.

The Acquiring Partner backend must detect this and return the necessary data points to Partners so they can start the Klarna’s purchase journey with the customers.

As shown in the below diagram, the high level flow is the following:

- Partner submits a Klarna payment request to the Acquiring Partner.

- Acquiring Partner calls the Klarna Payment Authorize API.

- Klarna returns a step-up required response containing:

payment_request_idpayment_request_url

- Customer enters Klarna’s purchase journey.

- Customer completes authentication/payment method selection.

- Klarna redirects the customer back to the Partner.

Integration details

Step 1: Receive data points from Partners

To support the step-up scenario, Acquiring Partners must define return URLs when calling the Payment Authorize API.

return_url: if the Klarna purchase flow is launched in a web environment, Klarna will redirect the customer to this URL after the customer finishes their interaction with Klarna, either by approving or aborting the purchase flow. This could either be a URL from the Acquiring Partner who will handle the redirection logic or a URL collected from the Partner.

app_return_url: The customer may be redirected to a third party app (bank app) or the Klarna app during the Klarna purchase journey on mobile environments. This URL enables Klarna to return the customer back to the Partner’s mobile app.

return_url and app_return_url are not mutually exclusive

In different scenarios, either or both of the return_url and app_return_url can be triggered:

Example 1: Only return_url is triggered – Pure web flow

The customer starts the Klarna purchase flow in a web browser on a desktop. After approving the purchase, they are redirected to the return_url.

Example 2: Only app_return_url is triggered – App-to-app flow

The Partner’s native mobile app opens the Klarna purchase flow using a universal link. If the Klarna app is installed, the customer is taken directly into the Klarna app. After approval, they are redirected to the app_return_url, returning them to the Partner's app.

Example 3: Both URLs are triggered – WebView flow with app handover

The Partner’s native mobile app starts the Klarna purchase flow in a System WebView. If the customer needs to authenticate via an external banking app, they’re handed back to the Partner's app using app_return_url. They then resume the purchase flow in the WebView and, upon completion, are redirected to the return_url.

Implementation notes for Partners

- Ensure the

app_return_urlis set up to register a URL scheme (e.g., yourapp://klarna) or universal link that resumes the payment flow. - Klarna uses this URI after the customer completes a native app-based flow (e.g., biometric auth in a bank app or Klarna app login).

- Partners are expected to open the integrating mobile application in its last state (no state changes or deeplink navigations).

When Acquiring Partners are already asking for a suitable return_url or app_return_url from the Partner, it is advised to not ask for a second one as this would increase the minimal integration requirements for Klarna to work.

Step 2: Configure step-up parameters

Acquiring Partners must include a step_up_config object when calling Klarna’s Payment Authorize API

| Parameter name | Description |

|---|---|

| Reference to the payment session or equivalent resource on the Acquiring Partner's side. Helps match Klarna payment requests with internal records. | |

Configuration properties for supporting step-up scenario. It contains:

|

Sample request

curl https://api-global.test.klarna.com/v2/accounts/{partner_account_id}/payment/authorize \

-H 'Authorization: Basic <API key>' \

-H 'Content-Type: application/json' \

-H 'Klarna-Network-Session-Token: eyJhbGciOiJIU...' \

-d '{

...

"step_up_config": {

"payment_request_reference": "acquiring-partner-request-reference-1234",

"customer_interaction_config": {

"method": "HANDOVER",

"return_url": "https://merchant.com/redirect",

"app_return_url": "merchantapp://klarna" Step 3: Extract & return mandatory Klarna parameters

Whenever the step-up scenario is triggered, the Payment Authorize API response will contain

payment_request_id: The unique Klarna identifier for the payment requestpayment_request_url: A URL to launch the Klarna purchase journey

Sample response

{

"payment_transaction_response": {

"result": "STEP_UP_REQUIRED"

},

"payment_request": {

...

"state_context": {

"customer_interaction": {

"method": "HANDOVER",

"payment_request_id": "krn:payment:eu1:request:552603c0-fe8b-4ab1-aacb-41d55fafbdb4",

"payment_request_url": "https://pay.test.klarna.com/eu/requests/6bbf6775-[...]/start"

}Forwarding Klarna parameters to the Partner

Acquiring Partners should extract and expose these parameters in their API response to the Partner system. This enables the Partner to:

- Redirect the customer to Klarna’s purchase journey directly, ensuring automatic app handover

- Use Klarna’s Web SDK or Mobile SDK to start the purchase flow

{

"status": "pending",

"klarna": {

"payment_request_id": "krn:payment:eu1:request:552603c0-fe8b-4ab1-aacb-41d55fafbdb4",

"payment_request_url": "https://pay.test.klarna.com/eu/requests/6bbf6775-[...]/start"

}

}

Avoid the use of intermediate redirects

Using an Acquiring Partner’s own redirect URL instead of sending Klarna’s payment_request_url directly causes issues with app handover, Klarna SDK compatibility, and network reliability — ultimately harming user experience and lowering Klarna’s purchase conversion.

In some implementations, the Acquiring Partner might be returning a general-purpose redirect_url under their domain for all payment methods. Partners then use this URL to trigger a client-side redirect to Klarna’s payment_request_url.

{

"status": "pending",

"redirect_url": "https://acquiringpartner.com/payment/xxxxx"

}

However, this pattern is generally discouraged due to the following limitations:

- Reduced app handover success: Cross-domain redirects decrease the likelihood of a successful automatic handover to the Klarna app, which can negatively impact Klarna’s purchase conversion rate.

- Incompatibility with Klarna SDK integration: This approach is not compatible with partners who use the Klarna Web SDK to optimize the purchase experience, such as enabling popup flows on websites or facilitating app-to-app handoff within native mobile applications.

- Network issues: frontend redirects expose customers to network issues.

Instead, expose Klarna’s payment_request_url directly to the Partners:

{

"status": "pending",

"redirect_url": "https://pay.klarna.com/xxxxx"

}

Step 4: Launch the Klarna’s purchase journey

Partners may have two options to start the Klarna purchase journey based on the parameters returned by Acquiring Partners:

- Launch the purchase journey directly using Klarna

payment_request_url - Use Klarna Web SDK or Mobile SDK to trigger the flow, based on the provided

payment_request_id.

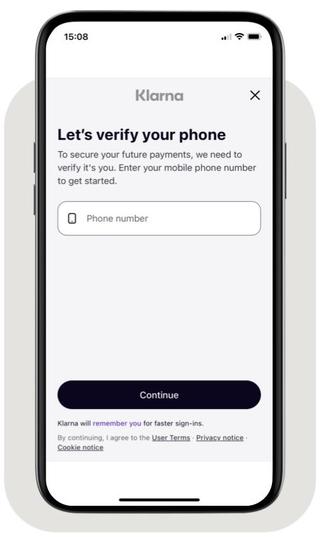

The Klarna purchase journey enables the customer to:

- Authenticate with Klarna (via login, OTP, etc.)

- Choose the payment method (Pay in N, Pay Later, etc)

- Accept the payment.

Phone collection in the Klarna purchase journey

Step 5: Handle customer return after Klarna's purchase journey

After the customer finishes or aborts the Klarna purchase flow—whether on web or in the app—Klarna does the following:

- Redirect the customer to

return_urland/orapp_return_url: Klarna redirects the customer to thereturn_urland/orapp_return_urlspecified in thecustomer_interaction_configobject. As discussed above, either or both URLs may be triggered, and app_return_url can even be invoked in the middle of the purchase flow. Therefore, avoid adding any special logic or dependencies to these URLs. - Issuance of

klarna_network_session_token(upon completion): Klarna issues aklarna_network_session_tokento the Acquiring Partner, which is required to finalize the payment. This part will be covered in the following section – Monitor the payment request state.