Enhance customer experience with Klarna’s Boost features by integrating interoperability flows, maintaining seamless sessions, and optimizing payment journeys across platforms.

Klarna enhances the shopping journey by streamlining payments, optimizing conversion, and enabling customer identification. Our offering includes On-site messaging, Express checkout, and Sign in with Klarna, along with marketing services such as affiliation and price comparison search, all designed to improve customer experience and Partner sales.

|  |  |

| Sign in with Klarna | On-site messaging | Express checkout |

To maximize interoperability, Acquiring Partners must support all Klarna services, ensuring seamless functionality across the Product Suite. While Partners handle product integration, Acquiring Partners must be prepared to manage interoperability flows, regardless of the integration type.

Key interoperability flows include:

- Earlier login through Sign in with Klarna

- Pre-qualification through On-site messaging

- Payment preparation through Express checkout

This ensures a smooth customer experience and optimized payment processing.

When a customer interacts with Klarna’s Boost features, Klarna maintains a customer session to ensure seamless transitions across platforms and domains. This session preserves payment capabilities throughout the journey of the customer, with the interoperability_token linking the session across all touch points. The sections below outline the essential flows enabled by Klarna's Product Suite and the expectations for each stakeholder to enable them:

Link copied!

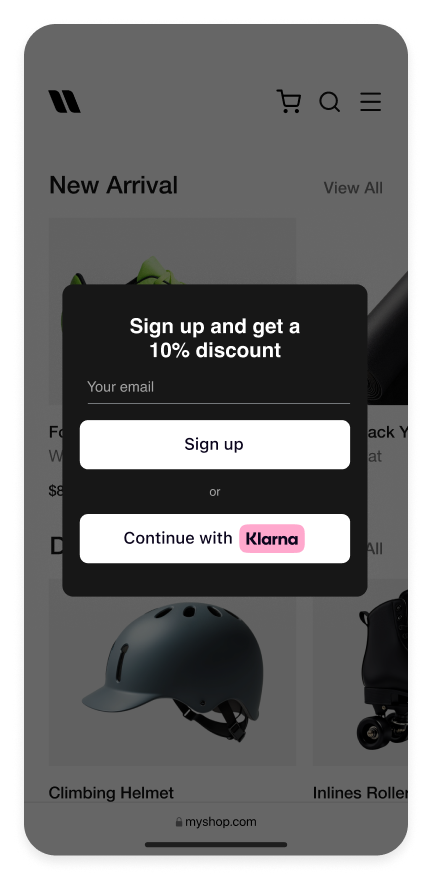

In this scenario, Partners have integrated our On-site messaging allowing customers to check their credit eligibility prior to entering the checkout process. This enables Klarna to pre-qualify the customer, allowing the Acquiring Partner to highlight Klarna as a payment option on the Partner’s website.

Interoperability data points are shared by Partners when submitting the payment with Acquiring Partners.

Diagram explaining how Pre-qualification works

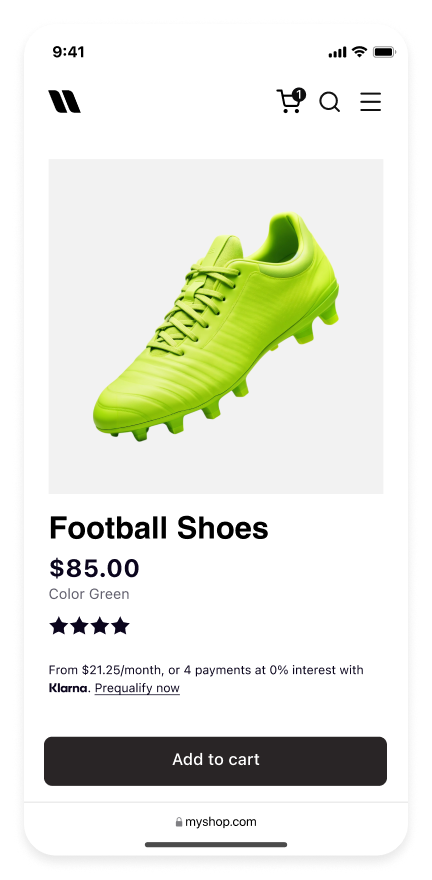

In this scenario, Partners integrate Sign in with Klarna to streamline the payment flow by allowing customers to log in to their website using their Klarna account. During this process, the Partner retrieves a customer token, which is then used to request an interoperability_token to initiate a checkout session with the Acquiring Partner.

Acquiring Partners should, when possible, preselect Klarna as the payment option and minimize the visibility of other payment methods. This ensures a seamless and efficient checkout experience while maintaining interoperability across all parties.

Diagram explaining how SIWK works

Link copied!

In this scenario, Partners use Klarna Express Checkout feature to offer a one-step purchase experience to their customers. This flow is available only for Partners with a server-side integration with their Acquiring Partner. Interoperability data points are shared by Partners when submitting the payment with Acquiring Partners.

Link copied!

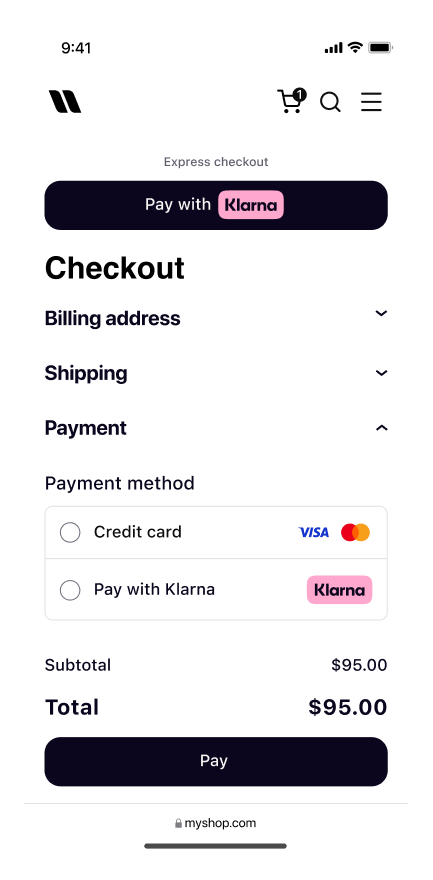

In this scenario, Partners use Express checkout with a review screen, allowing customers to review their purchase and adjust shipping details before finalizing the payment. This flow is available for all Partners, regardless of the integration path.

Interoperability data points, including the interoperability_token, are shared by Partners when creating the session with the Acquiring Partner before the review screen to ensure a seamless and coordinated checkout experience. After the review screen, Partners register the payment with the Acquiring Partner, requesting finalization to complete the transaction and ensure authorization by Klarna.

Diagram explaining how KEC multi-step works