Integrate Klarna Payment Services seamlessly with flexible options, including SDK and API solutions for a customized checkout experience. Ensure smooth interoperability across the customer journey with Klarna’s full product suite and Boost features.

To best integrate Klarna Payment Services as an Acquiring Partner into the checkout experience your Partners are building, we provide flexible integration options to accommodate various integration styles. These options allow you to tailor the integration to your specific needs and the needs of your Partners, as well as respect Klarna’s requirements such as enabling Interoperability across Klarna’s product suite.

For offerings in which the Acquiring Partner has a client-side component, such as hosted checkout solutions or embedded components, it’s required to utilize a client-side integration leveraging Klarna SDK and Klarna Partner product API. This ensures a seamless implementation of Klarna Payment Services directly on your platform, providing advanced functionality for security and ease of checkout.

Actors in the Klarna payment flow

Klarna involves several systems and participants that work together to complete a payment. Understanding their role is essential to implementing a compliant integration.

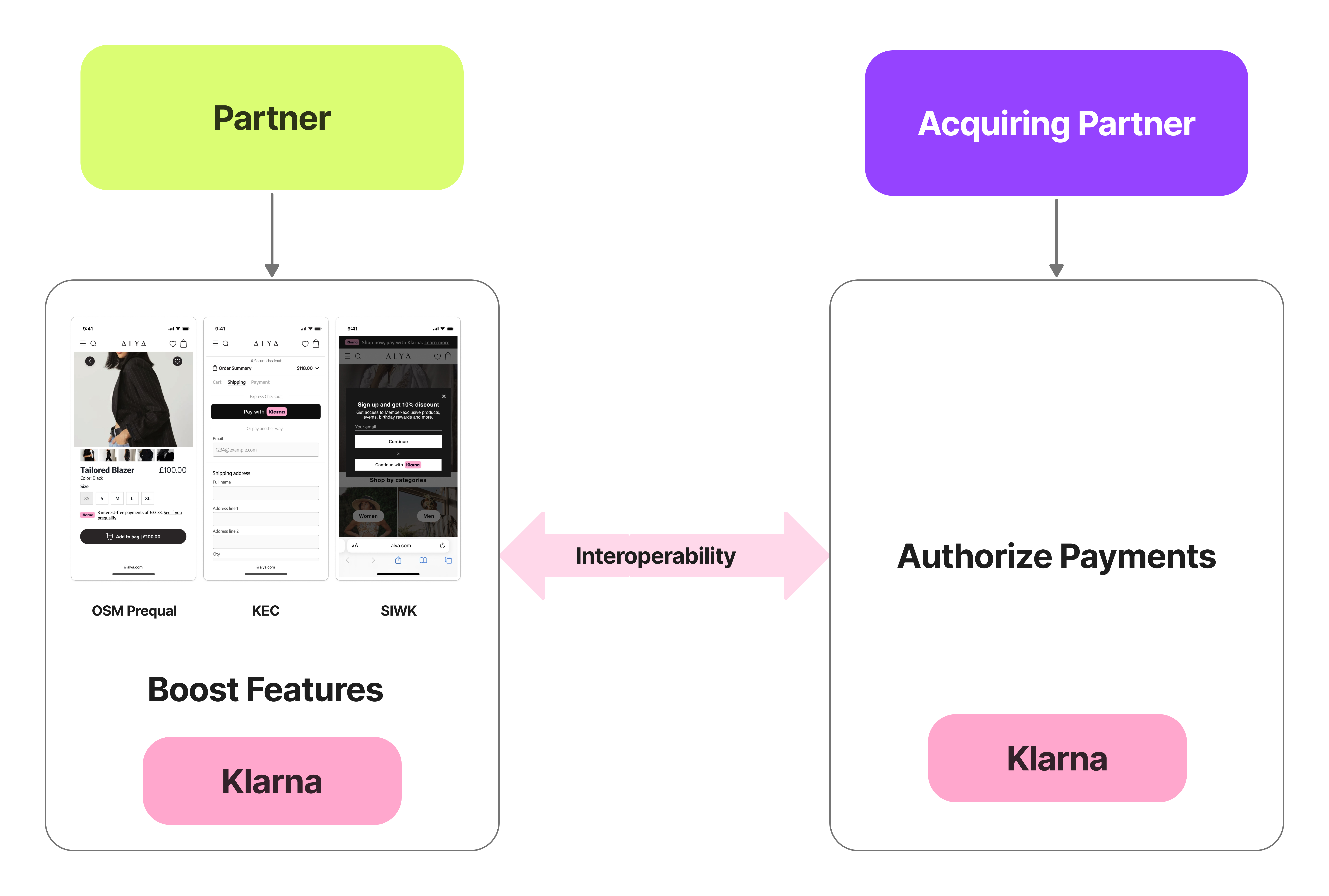

Partner: provides the customer-facing checkout. They may use hosted checkouts, embedded components, or server-side integrations. When their solution includes frontend components, they must integrate Klarna’s SDK to support Boost features and interoperability.

Acquiring Partner: processes Klarna payments on behalf of Partners. They trigger the payment authorization, handle payment requests when step-up is required, and manage the resulting payment transactions.

Klarna: evaluates whether a payment can be accepted based on customer eligibility, transaction details, and compliance rules. Klarna issues klarna network session tokens, evaluates payment authorizations, and manages the lifecycle of payment transactions.

Customer: the individual completing the purchase. Depending on eligibility and context, they may be prompted to review or approve the purchase during a step-up scenario.

Core principles enabling Klarna's Purchase Journey

A payment with Klarna is represented as an entity called Payment Transaction in Klarna’s Product API. But before being able to manipulate a Payment Transaction, the payment has to be authorized by Klarna. With this in mind, it is critical to understand the different elements leading to a Payment Transaction: Payment Authorization and Payment Requests.

Payment Authorization

A Payment Authorization is always the first and last step in completing a payment. The operation is triggered by the Acquiring Partner and will evaluate whether a payment is accepted by Klarna using the transaction details, customer eligibility, and compliance requirements. The outcome of the Payment Authorization may be influenced by the customer's earlier interactions with boost features implemented by the Partner. For example, a payment authorization attempt may immediately be approved and respond with a Payment Transaction, for example when the customer went through a Klarna Express Checkout session on the Partner website. It can also lead to a step-up where the Acquiring Partner will need to take the customer through a Payment Request.

Payment Request

A Payment Request is triggered only when additional customer interaction is required, typically in cases where the Payment Authorization cannot be immediately approved. This is referred to as the step-up scenario. A Payment Request holds all details that the customer will be able to review when approving the purchase through Klarna’s Purchase Journey.

Payment Transaction

A Payment Transaction represents the record of a payment within Klarna’s system. It can be completed (fully captured, or void) or pending (waiting for capture). It serves as the foundation for all subsequent operations, including capturing funds, issuing refunds, voiding payments, reconciliation, and dispute management.

Interoperability between Klarna's Purchase Journey and Boost features

Beside payments, Klarna provides a set of services to accelerate Partner checkouts. Acquiring Partners must ensure Klarna is implemented in a way that guarantees all services and their associated functionalities are either fully enabled or consistently accessible across all integration points. This requires seamless interoperability between the payment integration of the Acquiring Partner and any Boost features implemented by the Partner to maximize the effectiveness of a Klarna Network integration.

In an optimized checkout experience with Klarna’s Product Suite, interoperability will allow both Partners and Acquiring Partner to implement Klarna features as detailed below:

- The Partner implements boost features to enhance the checkout experience for Klarna customers and drive conversion. These include but is not limited to Sign In With Klarna, Klarna Express Checkout, On Site Messaging with Pre-qualification.

- The Acquiring Partner is responsible for handling the authorization of Klarna payment transactions for the Partner. By supporting interoperability, any customer actions made before the Payment Authorization will increase conversion rate and time to accept the payment.

Interoperability ensures seamless integration of Klarna’s full product suite across the customer journey. The full potential of Klarna’s services is unlocked when all available features are effectively utilized. Given the multi-party nature of a Klarna Network integration, achieving interoperability requires both Partners and Acquiring Partners to integrate Klarna’s solutions in a coordinated manner.

Within Interoperability there are 2 key parameters that should be considered:

- The klarna_network_session_token is an opaque token issued by Klarna that ensures a seamless customer journey across different integrations. It contains all necessary information, including expiration details, which are set by Klarna, however a Partner can issue a new token within a session. Expired or invalid tokens are ignored for API resilience, and Acquiring Partners should not run any validation on the token.

- The klarna_network_data is a serialized JSON object that adheres to Klarna’s Klarna Network Data Schema, allowing Partners and Acquiring Partners to send additional data points to improve conversion rates and enhance the customer experience. When available, this data should be forwarded in all API interactions related to accepting payments, tokenizing a customer, initiating a checkout flow, and post-purchase operations such as captures and refunds.